|

Retire Early

Lifestyle

Retirement; like your parents, but way cooler

|

In 1991 Billy and Akaisha Kaderli retired at the age

of 38. Now, into their 4th decade of this

financially independent lifestyle, they invite you

to take advantage of their wisdom and experience. |

|

Why Your

House Is a Terrible Investment

Jim Collins writes about his passion for travel and the investing strategies

that support it. His Blog is best known

for describing the importance of accumulating F-you Money and the

Stock Series posts on

investing for it.

My pal James Altucher calls home ownership

a part of The American Religion, so I know I’m treading dangerous ground here.

But before you get out the tar and feathers, let’s do a little thought

experiment together.

Imagine over a cup or coffee or a glass of

wine we get to talking about investments. Then maybe one of us, let’s say you,

says:

“Hey I’ve got an idea. We’re always talking

about good investments. What if we came up with the worst possible investment we

can construct? What might that look like?”

Well, let’s see now (pulling out our lined

yellow pad), let’s make a list. To be really terrible:

It should be not just an initial, but

if we do it right, a relentlessly ongoing drain on the cash reserves of the

owner.

It should be illiquid. We’ll make it

something that takes weeks, no – wait – even better, months of time and effort

to buy or sell.

It should be expensive to buy and

sell. We’ll add very high transaction costs. Let’s say 5% commissions on the

deal, coming and going.

It should be complex to buy or sell.

That way we can ladle on lots of extra fees and reports and documents we can

charge for.

It should generate low returns.

Certainly no more than the inflation rate. Maybe a bit less.

It should be leveraged! Oh, oh this

one is great! This is how we’ll get people to swallow those low returns. If the

price goes up a little bit, leverage will magnify this and people will convince

themselves it’s actually a good investment! Nah, don’t worry about it. Most will

never even consider that leverage is also very high risk and could just as

easily wipe them out.

It should be mortgaged! Another

beauty of leverage. We can charge interest on the loans. Yep, and with just a

little more effort we should easily be able to persuade people who buy this

thing to borrow money against it more than once.

It should be unproductive. While

we’re talking about interest, let’s be sure this investment we are creating

never pays any. No dividends either, of course.

It should be immobile. If we can fix

it to one geographical spot we can be sure at any given time only a tiny group

of potential buyers for it will exist. Sometimes and in some places, none at

all.

It should be subject to the fortunes

of one country, one state, one city, one town…No! One neighborhood! Imagine if

our investment could somehow tie its owner to the fate of one narrow location.

The risk could be enormous! A plant closes. A street gang moves in. A government

goes crazy with taxes. An environmental disaster happens nearby. We could have

an investment that not only crushes it’s owner’s net worth, but does so even as

they are losing their job and income.

It should be something that locks its

owner in one geographical area. That’ll limit their options and keep ’em docile

for their employers!

It should be expensive. Ideally we’ll

make it so expensive that it will represent a disproportionate percentage of a

person’s net worth. Nothing like squeezing out diversification to increase risk.

It should be expensive to own, too.

Let’s make sure this investment requires an endless parade of repairs and

maintenance without which it will crumble into dust.

It should be fragile and easily

damaged by weather, fire, vandalism and the like. Now we can add-on expensive

insurance to cover these risks. Making sure, of course, that the bad things

that are most likely to happen aren’t actually covered. Don’t worry, we’ll bury

that in the fine print or maybe just charge extra for it.

It should be heavily taxed, too.

Let’s get the Feds in on this. If it should go up in value, we’ll go ahead and

tax that gain. If it goes down in value should we offer a balancing tax

deduction on the loss like with other investments? Nah.

It should be taxed even more! Let’s

not forget our state and local governments. Why wait till this investment is

sold? Unlike other investments, let’s tax it each and every year. Oh, and let’s

raise those taxes anytime it goes up in value. Lower them when it goes down?

Don’t be silly.

It should be something you can never

really own. Since we are going to give the government the power to tax this

investment every year, “owning” it will be just like sharecropping. We’ll let

them work it, maintain it, pay all the cost associated with it and, as long as

they pay their annual rent (oops, I mean taxes) we’ll let ’em stay in it. Unless

we decide we want it.

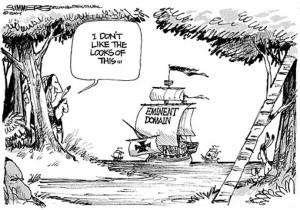

For that, we’ll make it subject to

eminent domain. You know, in case we decide that instead of getting our rent

(damn! I mean taxes) we’d rather just take it away from them.

Here are two more offered by readers…

Mr. Risky Start-up: It should

increase stress, lead to more divorces, but then be impossible to divide.

DMDave: You only need one motivated

(read: desperate) seller to set the price for the whole neighborhood. Imagine

your so-called “investment” suddenly get scuttled when your neighbor decided to

sell his particle-board mansion at 20% below assessment.

Boy howdy! That’s quite a list! Any

investment that ugly would make my skin crawl. In fact, I’m not sure you could

rightly call anything with those characteristics an investment at all.

Then, too, the challenge would be to get

anybody to buy this turkey. But we can. In fact, I bet we can get them not only

to buy but to believe doing so is the fulfillment of a dream, indeed a national

birthright.

A few weeks back I was at an awards

banquet and sitting at our table was a woman I know. She began talking about how

she was encouraging her young son to buy a house. You know. Stop throwing away

money on rent and start building equity.

I suggested that, since her son was single,

living alone and without children maybe he didn’t actually need a house. That if

he didn’t need one, maybe he should consider some alternatives instead. Or at

least run the numbers first.

This didn’t sit well and it was a short

conversation. It ended when she said, “Well, he’d be better off buying a house

than a clapped-out Camaro!”

Well, yeah. Maybe so. If this is the only

alternative.

Retire

Early Lifestyle appeals to a different

kind of person – the person who prizes their

independence, values their time, and who doesn’t

want to mindlessly follow the crowd.

HOME

Book Store

Retire Early Lifestyle Blog

About Billy & Akaisha

Kaderli

Press

Contact

20 Questions

Preferred

Links

Retirement

Country Info

Retiree

Interviews

Commentary

REL

Videos

|