|

Retire Early

Lifestyle

Retirement; like your parents, but way cooler

|

In 1991 Billy and Akaisha Kaderli retired at the age

of 38. Now, into their 4th decade of this

financially independent lifestyle, they invite you

to take advantage of their wisdom and experience. |

|

Living off

Dividends or Selling Stock Shares - What Should I Do?

Q and A with a Reader

Billy and Akaisha Kaderli

Hello Billy & Akaisha,

Thank

you for sharing your experience with all.

I continue to enjoy many of your

articles.

My wife and I retired 4 years

ago, me 60, she 56. Now we

live in PalaU, Thailand.

Iíll try to make my question understandable, I

hope. I am invested, mostly in dividend paying stocks, and some bonds, and

also several diversified value funds, which pay lower dividends.

My way of

thinking, is that if I only withdraw my dividends (and possibly some capital

gains distributions if I need more), I will never deplete my number of shares.

I feel comfortable with this method.

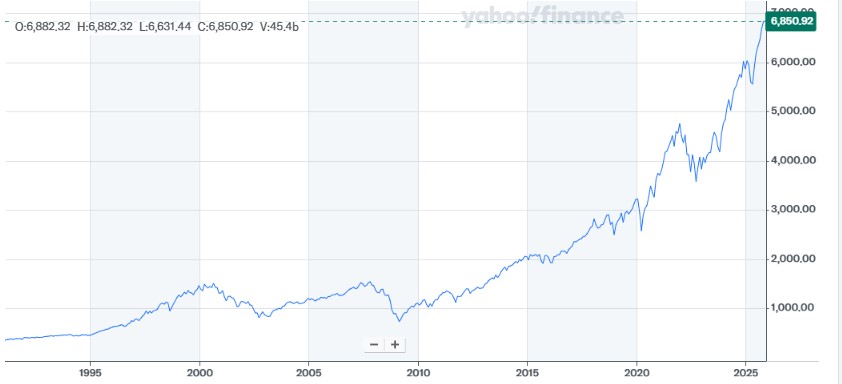

S&P 500 Index return 1991 - 2025

But, when I think about an

alternative approach that you have been successful with - of using funds like an

S & P 500 - I know I would need to withdraw more than the 1.2% dividends in

order to have enough money to live on. So that means I would need to sell

some shares to do this. Even though you have proven it works and it can be

done, I can not get my mind to understand how selling my shares (shrinking my

share balance every year) makes sense.

I realize the share value

increases over time, but for some reason, I just canít figure out how to feel

comfortable with investing this way.

I even believe that I would most

likely have a stronger portfolio performance with the S & P 500 method.

I

have a fear of seeing my share balance go lower every year.

Do you have

any illustrations that might help me and others grasp this proven way to provide

an income in retirement? I have never seen any articles anywhere about

this topic.

I would truly appreciate any help with this!

Jeff & Trina

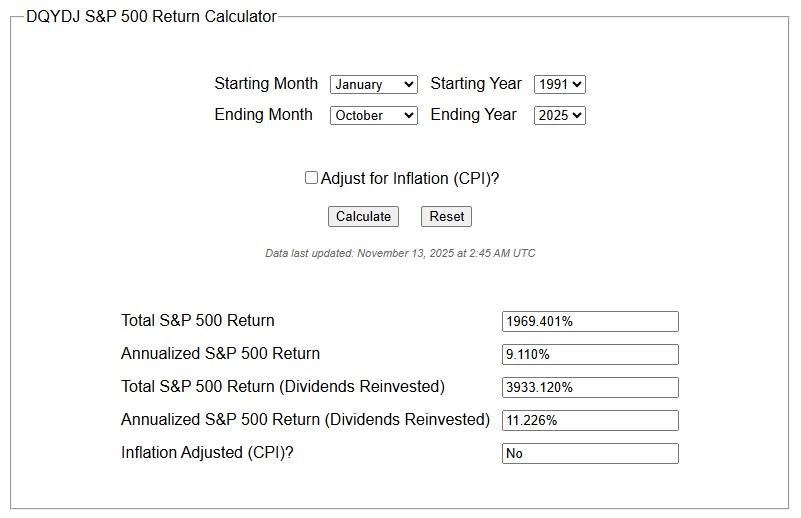

11.226% Annualized Return since we retired

in 1991.

Hi Jeff and Trina,

Thanks for

your interest in our articles.

Regarding withdrawal methods

- If you are comfortable

with what you are doing and itís working then leave it alone.

However, have you

factored inflation into your strategy? Inflation will slowly erode your

purchasing power over the years.

Perhaps your dividends will grow more than

inflation - or not - I do not know. If they do you will be in great shape. But if

they donít you will be slowly going backwards.

Using the S&P 500 index as an

example,

it has historically grown about 10% - including dividends - per year.

If inflation is running at 3%

per year (the 70-year historic average), you have a

net return of 7% after inflation.

If

your spending is 4% or less,

then you have 3% to

keep in the market for growth.

The number of shares is not important. Itís the

share price that matters. You can have 50,000 shares of a 1 Dollar stock, or you

can have 1 share of a $50,000 company, you still have the same amount.

When we were

younger, we utilized reverse dollar cost averaging by selling shares as they appreciated

in value to cover our living expenses.

As we have grown older (but not up),

receiving

Social Security and having Required Minimum Distributions from

retirement accounts, we now do a combination of both.

Soon to be entering into our

36th year of financial independence and freedom from the workplace, our net

worth has grown out-pacing both inflation and our spending.

You have to be

comfortable with whatever you choose to do, just be sure you are covering

inflation creep.

Best of luck to you and enjoy Thailand.

Billy and Akaisha

Retire

Early Lifestyle appeals to a different

kind of person Ė the person who prizes their

independence, values their time, and who doesnít

want to mindlessly follow the crowd.

HOME

Book Store

Retire Early Lifestyle Blog

About Billy & Akaisha

Kaderli

Press

Contact

20 Questions

Preferred

Links

Retirement

Country Info

Retiree

Interviews

Commentary

REL

Videos

|