|

Retire Early

Lifestyle

Retirement; like your parents, but way cooler

|

In 1991 Billy and Akaisha Kaderli retired at the age

of 38. Now, into their 4th decade of this

financially independent lifestyle, they invite you

to take advantage of their wisdom and experience. |

|

Going Naked

(of Health Insurance)

Billy and Akaisha Kaderli

The ever-present question

It is such a fatiguing topic and one that

is filled with emotion and fear. As a nation we can hardly get past it and

present solutions are sometimes as hard to handle as the problem itself.

I’m talking about the price of the

administration of health care.

High cost and obstacles

We know a couple who pays thousands of

dollars a month for a catastrophic, high deductible plan in the States and they

have never had a claim.

Another couple pays even more just for the

husband’s ability to be insured with his pre-existing heart condition.

Some people are not able to be covered at

all with US insurance companies due to a completely cleared up medical condition

that happened 5, 8, or 10 years ago. They feel they are just twisting in the

wind and waiting for the next shoe to drop.

Hospital room in Chapala, Mexico

Sometimes our readers write to us about

staying in their jobs for another 5 years or more to qualify for employer

covered health insurance that will last “forever.” Is it worth it? they ask.

They feel like they are spending their healthy years chained to a job that has

lost its luster for something in the future that might not exist when they need

or want it. Or the parameters will have changed so much that they’ll wonder if

it was all worth it.

To look into private, national and international insurance options, click here

Going naked

As you know, Billy and I have traded

security for adventure many times in our lives. And when it comes to health

insurance and the price for the administration of health care, it’s no

different. Medical Tourism is a viable option and one that we espouse in our

articles and books. We have been called on the carpet for our decisions in this

area more than once.

However, among world travelers there is a

phrase we use when we discuss health insurance policies and whether or not we

want to continue holding one and paying the corresponding price tag.

It’s called “going naked” or “going

semi-naked.”

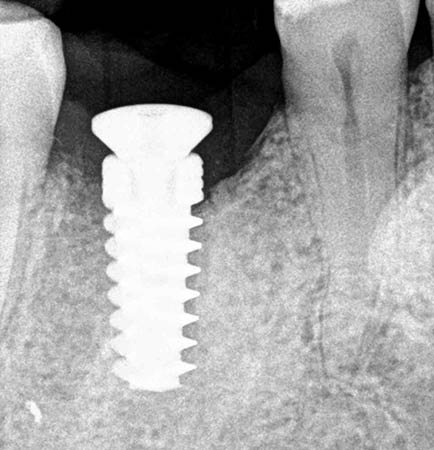

Dental implants done in Mexico and Central America

This phrase pretty much describes how it

feels when one chooses to let that insurance policy go. One can feel pretty

exposed and vulnerable – at least in the beginning. On the other hand, not

being tied to a $12,000 -$24,000 or more payment per year opens up other

possibilities.

After a few years without a policy payment

one can save enough money to afford out-of-pocket something unexpected medical

event.

For the most part we’re talking about

travelers here, so these are people not living a full time traditional life in

the States. They have made certain decisions and trade-offs to have the life

they enjoy, and they have already received health care in other countries.

Going to a doctor in a foreign country for

the first time can be unnerving. But then after experiencing the care, realizing

the doctor speaks English, seeing the hospital or clinic with their computers

and quality equipment and having the heart-felt care, things get placed into a

better perspective.

Modern international hospital, Guatemala City, Guatemala

Those who have never had medical service

out of their own home country tend to look at this topic with jaded eyes or

great suspicion.

It’s understandable.

Those who have gone through this experience

feel their eyes have been opened to new possibilities. The idea of “going naked”

of an insurance policy becomes a manageable possibility. Going “half-naked”

(choosing a high deductible policy or travel insurance when visiting the States)

is a comfortable middle ground.

To find

international dentists, hospitals, and clinics, click here

Your choice

Once again, Billy and I are not advising

anyone to do anything. We present options to challenging situations, and you can

ruminate about it or toss it into the round file.

But one thing we see over and over again is

how this one subject seems to be over-weighted as compared to other themes that

could generate happiness and comfort in one’s retirement life. Categories such

as cost of living, reasonable weather, having a community of friends and

energizing, rewarding activities to do, for instance.

There is no one size fits all, to be sure.

But if the overbearing cost of

administration of health care is a concern in your retirement plans, you might

consider some working alternatives.

For more information on Medical Tourism,

click here.

For Alternative Medical options,

click here

Related articles:

Top Ten Questions and Answers on Medical Tourism

To educate yourself on alternative care and

leading edge technologies, click here.

click here

Experiencing Covid in Mexico - One man's medical adventure

Also you can check out these websites, which

are overseas: Central America

Surgery/Doctors, and

Central American Dental.

About the Authors

Retire

Early Lifestyle appeals to a different

kind of person – the person who prizes their

independence, values their time, and who doesn’t

want to mindlessly follow the crowd.

HOME

Book Store

Retire Early Lifestyle Blog

About Billy & Akaisha

Kaderli

Press

Contact

20 Questions

Preferred

Links

Retirement

Country Info

Retiree

Interviews

Commentary

REL

Videos

|