|

Retire Early

Lifestyle

Retirement; like your parents, but way cooler

|

In 1991 Billy and Akaisha Kaderli retired at the age

of 38. Now, into their 4th decade of this

financially independent lifestyle, they invite you

to take advantage of their wisdom and experience. |

|

Unlocking

Millionaire Status: The Power of Starting Early and Compounding

Billy and Akaisha Kaderli

Martha, Lori, Vicki, and Akaisha, all

Early Retirees

Have you ever dreamt of financial

freedom?

Traveling the world without a budget? Retiring early and pursuing your

passions? Becoming a millionaire might seem like a distant fantasy, but with

the right strategy, it's closer than you think.

Enter the power of compounding: the magic

of your money earning interest on its own interest, snowballing over time.

Forget quick fixes and latte sacrifices. Let's unlock the millionaire

mindset with a strategy anyone can start today.

Wow! Sounds great doesn’t it?

Well, you can become a millionaire and

live the

life of your dreams.

Everyone has heard that

if you just give up that digital toy or pack your lunch daily you can achieve this

goal. And you can, but that's only half of the story, perhaps you can wrap your mind around the following idea more

easily.

When to begin

Meet Sally, the Compounding Queen:

On the day she was born she deposited $10.00 Dollars into the S&P 500

index. Fidelity is now offering a no fee, no minimum account balance fund

which would work for this.

Assuming that the S&P 500

Index performs as it has for the last 100 years, Sally's investment will grow at a ten percent annual rate

with dividends re-invested.

Chart of the S&P 500 performance from

January, 1923 to January, 2023, Over a 10% Annual Return

Sally knows that ten dollars isn’t going

to get her to a million in her lifetime - that’s how smart she is - so she

adds $10.00 each day, and after one year her account has grown to $3,838.21.

Not bad for her first birthday.

Sally also understands

the importance of paying herself first. Before that Latté, before going out

shoe shopping, before anything else including rent, car payments or

purchasing a home, she makes

her deposit into her future.

She continues with her

investment plan making contributions daily, and on her 34th birthday her

account has grown to $1,047,105.61. Congratulations Sally on being a

millionaire and - while most of her friends are trying to figure out what

they are going to do with their lives at that age - she has accumulated a

substantial nest egg.

This is the

Power of compounding.

But Sally isn’t finished.

She has big dreams.

So she continues with making ten dollar daily deposits

into her account and on her 40th birthday has close to two million dollars;

$1,934,668.51. Wow, in just six years almost a doubling of her account

value, and her total daily investment was only $146,000 over that forty year

period.

Again, this illustrates

the Power of

Compounding.

What if you start

later in life? Now everyone cannot be as

smart as Sally and begin investing right at birth, but Johnny is no

slouch and began his program on his 15th birthday with his grass cutting,

leaf raking and snow removal proceeds and by the time he was 55 years old

- which is considered

early

retirement - he too accumulated close to 2 million

Dollars.

Even if you waited until

you were 25 years old to start this plan when you reach the retirement age

of 65 you will have a sizeable net worth.

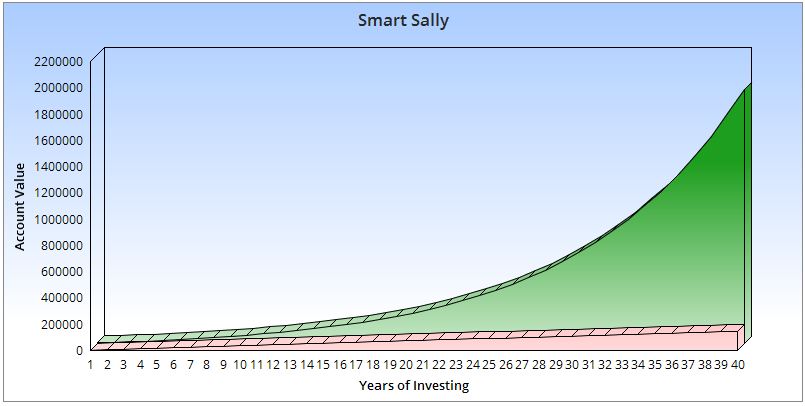

Chart of Smart Sally's years of

investing and her contributions. This

pay-yourself-first-plan is separate from your student loans, from your

company's 401(k) matching plans, separate from purchasing a

vacation, a home, or having a child. This money is for YOU, and is not to be

touched for anything else in your life until it can produce enough gains per

year to cover your living expenses.

Once there, you are considered

to be

Financially Independent.

Start Early: The earlier

you begin, the more

time your

money has to compound. Even small amounts add up!

Pay Yourself First: Treat

your future self like a bill you can't ignore. Automate your investments to make

it effortless.

Invest Consistently: Even

small, regular contributions can lead to big results. Focus on the long game.

You, too, can

travel the

world and live your life

on

your terms.

What are you waiting for?

Take charge of your life and make it happen.

Start today!

What's Your Number? - How much money do you need to retire?

About the Authors

Retire

Early Lifestyle appeals to a different

kind of person – the person who prizes their

independence, values their time, and who doesn’t

want to mindlessly follow the crowd.

HOME

Book Store

Retire Early Lifestyle Blog

About Billy & Akaisha

Kaderli

Press

Contact

20 Questions

Preferred

Links

Retirement

Country Info

Retiree

Interviews

Commentary

REL

Videos

|