|

Retire Early

Lifestyle

Retirement; like your parents, but way cooler

|

In 1991 Billy and Akaisha Kaderli retired at the age

of 38. Now, into their 4th decade of this

financially independent lifestyle, they invite you

to take advantage of their wisdom and experience. |

|

Interview

with All Options Considered

Ali and Alison Walker

Billy and Akaisha Kaderli

We at Retire Early Lifestyle like to share

with you the stories of

Captivating

Characters. Below you will find another success story of a journey to

financial independence and personal satisfaction. Enjoy our interview with World

Travelers, Ali and Alison Walker.

Allison and Ali in San Miguel de Allende, Mexico

REL: Could you tell us a little about yourselves? What type of

work you did, what your life consisted of before FIRE?

Ali and Allison of All Options Considered: We’re both originally from California, Ali

from Northern California and Alison from Southern California. We each migrated

to Seattle during our careers which is where we met in 2004. Ali spent her

career in marketing and business development for firms that specialized in

architecture, engineering, and environmental science. Alison spent her career in

the print industry managing image retouching of high-end catalogs for numerous

well-known retail companies. We retired in 2018 when Ali was 44 and Alison was

54 years old.

REL: When did you start your journey to

Financial Independence?

What was your motivation? Were you both always on the same page with this goal?

AOC: During our careers we were very focused on saving

money and learning about passive income generation. We have always been on the

same page, though we often see things from different angles and make decisions

differently. We started managing our own investments in 2005 and we really

enjoyed soaking up as much money related content as possible from books and

podcasts, investing classes, and the women’s investment club we joined together.

Ultimately we both just needed time to build our confidence and stop worrying

about

having enough money. Our motivation for reaching financial independence

was to spend more time with each other and more time traveling, reading,

walking, cooking, watching movies, and enjoying life.

REL: Did you ever think it was possible to live a different

lifestyle other than the conventional one? What turned the light on for you to

think outside of box?

AOC: Alison’s aunt was a great source of inspiration for

us in terms of

financial independence. She retired early when she was 42 years

old and designed a lifestyle that was perfect for her. She taught us that

financial independence was possible, and she also taught us that everyone’s

retirement lifestyle

can and should be unique. Designing our own perfect

lifestyle took a long time because our jobs were a huge distraction.

During our careers the idea of leaving work for more than a few

days seemed like a challenge so we didn’t take very much time off for ourselves.

We finally took our first big vacation in 2014 and went to Europe, and that’s

when we fell in love with the idea of travel and really started to get serious

about

financial independence. Travel helped us see past our career focused lives

and imagine life after retirement, which is why we spent our first two years

after FIRE traveling internationally full time as nomads.

Isle

of Wight, England

REL: Would you consider yourselves to be Financially Independent?

Do you consider passion projects or side jobs to supplement your lifestyle?

AOC: Yes, we are financially independent. At this point we

don’t have paychecks or other forms of new income to save or invest, and it’s

amazing to see

how much our portfolio continues to grow even without new income

and with market downturns. Now that we’re retired and

our

annual income is

covered by our investments we spend a lot of our time on financial coaching and blogging. At this point we have not monetized our blog though we have been

encouraged to do so and we might consider monetizing at some point. But we don’t

accept payment for our time and we have no intention of changing that in the

future. We love to

support other people and projects that we believe in so we

offer our time and ideas to other people for free as part of our own personal

giving plan.

REL: The

cost of housing is one of the highest cash outlay in any

household budget. In your retirement lifestyle, did you choose to keep a home?

Relocate? Travel? Do you have a home base now? Where do you keep all your

“stuff”?

AOC: We spent our first two years after reaching FIRE

traveling full time, and learned that nomadic travel is a lifestyle that we

love. We gave ourselves a $50 per night housing budget as an average for our

travels and in some locations like

Ho Chi Minh

City or San

Cristobal de las Casas we spent much less than that, while in other locations like Paris and

London we spent more than that. We also do some

house

sitting when we travel to

help control costs and to meet new people in other locations. We’ve had some

fabulous house sitting experiences in the

USA,

Mexico,

Panama,

Ecuador, and

Thailand.

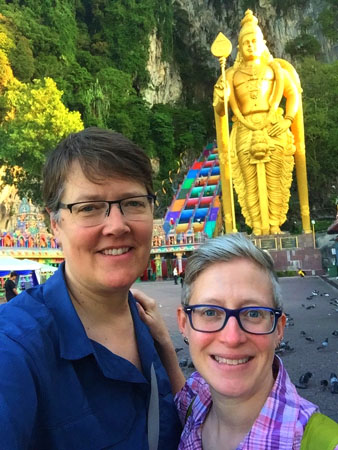

Batu

Caves, Malaysia

Since we weren’t sure how long our nomad life would last when we

sold our condo in Seattle in 2018, we decided to put some of our favorite things

in storage. That turned out to be the right decision for us since the type of

traveling we wanted to do came to a stop less than two years later during the

Covid-19 pandemic. We’ll spend most of 2021 in our own home that we bought in

September 2020 in

Arizona, partly because

Covid made our international nomad

life impossible but also because we want to spend as much time as possible with

family right now. We plan to keep house sitting when we can, and in fact we’re

house

sitting right now as we work on this interview for you!

REL: How long have you been Financially Independent?

AOC: We were slow to test our numbers and declare that we

were financially independent, but we finally verified that we had surpassed the

number we wanted to reach for financial independence in 2017. We know we could

have retired a few years earlier than we did and acknowledge that we were

nervous about pulling the plug on work and trusting in our investments. Now that

we’re retired we’ve been able to

unravel the emotional side of financial

independence, which is why we enjoy doing some financial coaching for others who

are going through the process of

planning for FIRE themselves.

REL: In your retirement life, what do you do about access to

health care? Are you open to

Medical Tourism?

AOC: For 2021 we have a subsidized ACA health plan to

cover us in the USA. While we were international nomads we had a

global medical

insurance plan, which we barely used since health care costs are so affordable

in other countries. We had some fantastic experiences with medical tourism

including seeing a variety of doctors in Panama and dentists in Thailand,

Panama, and Mexico. We look forward to more medical tourism experiences in the

future.

REL: What do you

average in spending annually? Does this include

health insurance? Do you track your spending?

AOC: We

track

every penny we spend and enjoy following a

detailed budget. We averaged $60k in spending for our first two years of

retirement while traveling full time including health insurance, giving, taxes

and everything else we spent money on. For those two years of travel we spent

around 46% of our budget on things like health insurance, family and charitable

giving, our storage unit, quarterly income taxes, and audiobook and tv/movie

streaming subscriptions. Then we spent about 21% on food and beverages, about

24% on housing, about 6% on transportation, and about 4% on admissions and other

fun activities. Our budget will be very different this year in 2021 since we’ll

be living in one place in the USA.

Amboise, France

REL: Can you share with us anything about how your portfolio is

structured? Did your retirement affect your asset allocation at all?

AOC: Now that we’re retired we want a low risk / low

maintenance

retirement portfolio. We keep all of our accounts with Schwab, and

all of our investments are in market index ETFs with an allocation of 75%

equities and 25% bonds. We also keep a three year emergency fund in cash. We

still make a couple of proactive moves in our portfolio every year including

withdrawal of our annual living expenses in January, portfolio rebalancing in

May, and Roth conversions in December.

REL: What was your biggest challenge to obtaining Financial

Independence?

AOC: In a sense we took our earliest steps towards FIRE in

2005 by starting to manage all of our own investments but we didn’t yet have the

personal finance

vocabulary or financial support structure we needed at that

time. We were drawing from a blend of different financial lessons we learned

from our family members at that time including both successes and failures.

Finally in 2014 we found the FIRE movement and a few good examples to learn from

in other bloggers, podcasters, and authors including you guys at

RetireEarlyLifestyle. But making a plan that was perfect for us and building the

confidence we needed to put our plan into action took a couple more years. In

2017 we finally tested our numbers with a CFP and took the time to build a plan

and put it in writing which we called our Personal Money Statement. Having a

plan gave us the structure and personal accountability we needed to retire and

change our lives in 2018.

REL: What did your family and friends think of your choice to

leave your jobs and previous life behind?

AOC: A few of our family members were really worried that

we were putting ourselves in jeopardy when we told them about our FIRE plans.

And

most of our friends were pretty shocked by our decision to retire, sell our

home, and leave our career focused lives behind. But a few of our friends

thought our plans were inspiring and we have been thrilled to see them making

changes in their lives and finding their own versions of financial independence

to pursue.

Miyajima, Japan

REL: What has surprised you the most about your journey to FIRE?

AOC: Most of the time we felt like we weren’t really doing

anything that unusual in terms of saving for retirement, we were just trying to

grow our investments over time and making incremental adjustments along the way.

The biggest surprise was how easy it was emotionally to really walk away from

our careers once we finally resigned.

Deciding it was ok to quit was hard, but

walking away was easy.

REL: What inspires you about your new life?

AOC: The freedom to spend our time, energy, and money on

what we care about and enjoy most is incredibly inspiring.

REL: What is exhilarating beyond words? Something you would never

trade about your lifestyle to obtain “security?”

AOC: Our time as nomads was exhilarating beyond words and

it changed us forever. During our first two years of retirement we visited

12 different

countries (not including the USA) and stayed in 31 different cities in

those countries. We met a lot of amazing people during our travels and built

some really important friendships along the way. We love spending time in other

countries, learning the history of other places, meeting new people,

trying

different foods, and learning about other cultures.

REL: So far, what has been your biggest challenge with your new

lifestyle?

AOC:

Covid-19 has been the biggest challenge we’ve faced

since retirement, but we have been really lucky ourselves since

the

virus hasn't hurt us personally it just temporarily stopped our travels.

Financial

independence has been our safety bubble, shielding us from the majority of

things people have worried about during the pandemic. Covid motivated us to

redirect ourselves, create a new home base to pause and be safe in, and focus

more on being supportive of other people.

REL: What would you say to someone who is considering tossing the

conventional lifestyle and retiring early? What advice would you give?

AOC: Build a community with people who have reached FIRE

themselves as well as other people who are also working towards financial

independence. Being able to talk openly with people about all of your financial

independence related plans, dreams, and questions makes a huge difference!

Grand

Canyon, USA

REL: What would you say are your most unique talents?

AOC: We are emotional, open minded,

flexible and

adaptable, which helps us cope with whatever is happening in our own lives. And

we care about other people and want to get involved and help where we can. We

each bring our own unique experiences from life along with experiences as women

and LGBTQ people, and try to reach a broad group of people who are hungry for

conversations about financial independence.

REL: What are your greatest passions in life?

AOC: Our greatest passion in life is each other, followed

by our family, friends, and other people. We’re very fortunate to have loving

family members who care about us and support us. We’re the proud aunties of six

nieces and nephews who we love spending time with, and watching them build their

own lives makes us very happy. We’ve also really enjoyed building our chosen

family and we’re thrilled that our chosen family is still growing.

REL: Tell us about your greatest personal success, not

necessarily finance related.

AOC: Our greatest personal success is definitely our

marriage. We’ve been together for more than 16 years and we feel incredibly

lucky to have found each other when we did.

REL: How do you

contribute to the world?

AOC: We love to support other people and projects that we

believe in with our time and our money. As part of our own personal giving plan

we offer our time and ideas to other people for free. We make charitable and

political donations every year and we also offer gifts of money in the form of

donations and scholarships for people to use in support of their financial

independence related projects.

REL: Where do you see yourself 5 years from now?

AOC: Back to traveling much more frequently! Our lives

have changed dramatically every year since we reached financial independence so

we try not to make assumptions for the future. But travel is our religion so we

certainly hope we’ll be traveling a lot 5 years from now.

Siem

Reap, Cambodia

REL: What is your biggest splurge?

AOC: The house we bought in September of 2020 feels like

the biggest splurge of our lives even though our new house cost half as much as

the condo we used to own in Seattle. Buying a house after retirement and after

living as nomads for two years was a totally different experience for us.

REL: Is there a happiness mantra or motto that you've found to be

very helpful?

AOC: YES! All Options Considered! We first came up with

All Options Considered in 2007 and made it our personal family motto. At the

time we were working on making a change from individual stock investing to

owning rental properties and we wanted to give ourselves permission to try

anything. We’ve used the idea of All Options Considered for every big financial

decision we’ve made together, and it has been a great mindset for us in terms of

learning

about personal finance and exploring our hopes and dreams so it’s an

idea we want to share with other people.

REL: What do you do for fun or entertainment?

AOC: We both love reading, writing, cooking,

watching movies, taking long walks, birdwatching, photography, and spending time

with friends and family. We also love building complex spreadsheets and talking

about money with other people.

REL: I understand that you keep a blog with your stories about

financial independence and travel. Where can people find your blog?

AOC: We share our stories on our blog, Facebook,

and Instagram.

Blog:

https://alloptionsconsidered.com

Facebook:

www.facebook.com/AllOptionsConsidered

Instagram:

www.instagram.com/alloptionsconsidered

We at Retire Early Lifestyle would like

to thank Ali and Alison for sharing their lives and financial independence

story with our Readers. We hope they have inspired you to follow your dreams

and to live your best life.

For more stories and

interviews of Captivating Characters and Early Retirees,

Click Here

About the Authors

Retire

Early Lifestyle appeals to a different

kind of person – the person who prizes their

independence, values their time, and who doesn’t

want to mindlessly follow the crowd.

HOME

Book Store

Retire Early Lifestyle Blog

About Billy & Akaisha

Kaderli

Press

Contact

20 Questions

Preferred

Links

Retirement

Country Info

Retiree

Interviews

Commentary

REL

Videos

|